It’s scary to think that anytime you use your debt or credit card in a public place, you could be targeted for fraud. But it’s a fact - scammers can place card reader technology (skimmers) onto select machines to extract the card number, expiration date, and full name from your card’s magnetic strip to access your money. However, staying alert and informed can help avoid falling victim to these card scams. Learn what card skimmers are and how to spot them with this helpful article.

What are card skimmers?

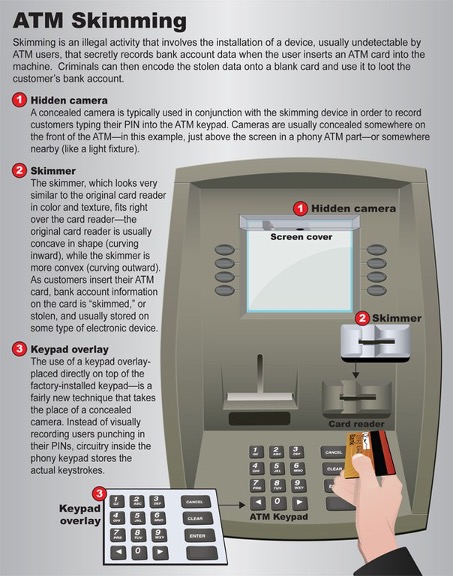

Card skimmers are card readers attached to the real terminals that extract the data from each card that is swiped without affecting the customer’s transaction. When a credit or debit card is swiped through a skimmer, the device captures and stores all the details from the card's magnetic stripe such as credit card number, expiration date, and the credit card holder's full name. The thief will typically plant the card skimmer during the night when no one is around and then return later to pick up the file containing the stolen data. Card skimmers can be attached to any card reader but are most often placed on ATMs and gas pumps since they are left unattended overnight.

What can the scammer do with the data?

Once the scammers have returned to the card skimmer and extracted the stored data, they can take the card number, expiration date, and cardholder name to either create clone cards or purchase items online. They can also withdraw funds from your account or conduct transactions from your account.

What should you look for to avoid being scammed?

The typical skimmer is smaller than a deck of cards and fits over the existing card reader. Most of the time, the attackers will also place a hidden camera somewhere in the vicinity with a view of the number pad to record PINs. The camera may be in the card reader, mounted at the top of the ATM, gas pump, or other machine type. Some criminals may install a fake PIN pad over the actual keyboard to capture the PIN directly, bypassing the need for a camera.

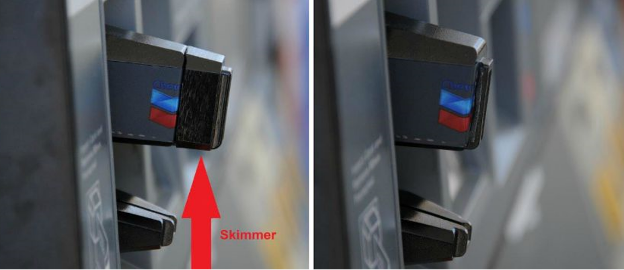

The difficult part of spotting card skimmers is that to the untrained eye, the point-of-sale card reader may not look any different from the norm; it will still have all the same parts as usual, but may simply be sticking out too far, be loose or jiggle, or be the wrong color.

When you approach a machine you’re using for a purchase, check for some obvious signs of tampering at the top, near the speakers, the side of the screen, the card reader itself, and the keyboard. If something looks different, such as a different color or material, graphics that aren't aligned correctly, or anything else that doesn't look right, don't use that machine. The same is true for credit card readers at the checkout line.

Look out for:

- A credit card reader that sticks out far past the panel. Skimmers are designed to fit over the existing credit card reader. If you notice a credit card reader that protrudes outside the face of the rest of the machine, it may be a skimmer.

- A security seal that has been voided. Gas stations often place a security label across the gas pump that lets you know if the cabinet panel on the fuel dispenser has been tampered with. When intact, the label has a flat red, blue or black background. However, once the seal has been broken, the words "Void Open" appears in white. If the seal is broken, it's a sign that someone without authorization has accessed the cabinet. Let the gas station attendant know and do not use the card machine at that pump.

- An extension or addition being attached to the end of the card reader. These skimmers do not require access to the inside of the terminal.

- A pin pad that's thicker than normal. In addition to a skimming device, thieves may place a fake keypad on top of the real one to capture your keystrokes. They can then capture your PIN or billing zip code in addition to your credit or debit card details. If the keys seem hard to push, it may be a sign that the terminal has a skimmer and keypad overlay.

- Different colors:

- ATM pieces not fitting together correctly. Below the slot where you insert your card are raised arrows embedded in the machine's plastic casing, to give users a hint about where their cards go. In the image above, you can see how the grey arrows are very close to the yellow reader housing, almost overlapping. That is a sign a skimmer was installed over the existing one, since the real card reader would have some space between the card slot and the arrows.

Please see image below provide by the Federal Bureau of Investigation (FBI):

How to protect yourself:

- Avoid using your PIN at the gas pump. When you pay at the pump with a card, you usually have the option to use it as a credit or a debit card. It's best to choose the credit option that allows you to avoid entering your PIN in sight of a card skimmer camera.

- Use a debit or credit card with EMV Chip Technology. While EMV Chip cards can still be compromised by a card skimmer, the data cannot be used to create a cloned card because additional security components are not found on the magnetic strip.

- If the card terminal accepts alternative transaction types, consider using tap to pay, Apple Pay, Samsung Pay, or Android Pay. These services tokenize your credit card information, so your personal information is never exposed. If a criminal somehow intercepts the information, they'll only get a useless virtual credit card number.

- Protect your PIN. Whenever you enter your debit cards PIN, assume there is someone looking. Scammers can collect your PIN from watching over your shoulder or through a hidden camera. To protect your PIN, cover the keypad with your hand when you enter your PIN. Obtaining the PIN is essential since the criminals can't use the stolen magnetic strip data without it.

- Jiggle every part of the ATM or Point of Sale machine. These machines are built to be sturdy, but card skimmers are attached externally. If you jiggle different parts of the machine and they feel loose, it may be a skimmer. Avoid using that machine.

- Look for newer ATMs (like the ones offered by Advia Credit Union): New ATMs include antitampering devices, sometimes including radar systems intended to detect objects inserted or attached to the ATM.

- Be cautious when using stand-alone ATM in stores, concerts, conventions, or fairs. These temporary ATMs are common targets for skimmers due to often being placed out of placed out of view and easily outfitted with a skimmer device.

How does Advia protect/help you if fraud happens on your account?

We take member financial safekeeping and identity protection seriously. When a member visits or calls, we take steps to confirm their identity before providing financial assistance. Our digital banking solutions provide state of-the-art layers of account security, including secure access code protection and other strong password requirements. Finally, our Fraud Monitoring Team works 24-hours a day to protect your financial security when making purchases with your Advia Debit or Credit Card. Advia’s fraud monitoring team will contact a member immediately if suspicious card activity is recognized, so updated contact information such as mobile phone, email, and mailing address is key. This can be updated 24 hours a day within our digital banking.

If you feel that you’ve been a victim of fraud, please notify Advia immediately. We will advise you to close your compromised account(s) to stop any further fraudulent transactions. We will then discuss with you how the possible fraud occurred and review your transaction history to see which transactions are legitimate. From there, a Risk Management Specialist will assist with figuring out the fraudulent activity.

https://www.pcmag.com/article2/0,2817,2469560,00.asp

https://www.lifewire.com/how-to-avoid-credit-card-skimmers-2487770